- COMMERCIAL MORTGAGE CALCULATOR QUICKBOOKS FULL

- COMMERCIAL MORTGAGE CALCULATOR QUICKBOOKS FREE

- COMMERCIAL MORTGAGE CALCULATOR QUICKBOOKS MAC

COMMERCIAL MORTGAGE CALCULATOR QUICKBOOKS FULL

Interest isn't charged after this payment is made, and the loan is considered to be paid in full at this point. Maturity Date: Sometimes referred to as the “life span” of a loan, the maturity date is the date on which a loan's final principal payment is made. The yield is calculated by dividing net operating income by loan amount (principal), and it shows what the cash-on-cash returns would be for a lender in the event of foreclosure. The ratio is calculated by dividing the loan amount (principal) by the total value of the asset (collateral).ĭebt Yield A ratio that shows the income generated by a property compared to how much is borrowed via a loan. Loan to Value Ratio: Commonly referred to as “LTV,” the loan to value ratio to determine risk exposure and to quantify a borrower's leverage. With real estate mortgages, the collateral used is the property that's purchased. Should the borrower fail to repay on a loan, the lender may seize any collateral that's provided against the loan. Any value above one shows that the debt is too much for an individual or business.Ĭap Rate: Amount by which an adjustable mortgage rate may decrease or increase at each periodic adjustment.Ĭollateral: The asset that's used to secure a loan. To calculate DSCR, divide your net operating income by your total debt service. One basis point equals 0.01%ĭebt Service - The money required to cover monthly or annual loan paymentsĭebt Service Coverage Ratio: Commonly referred to as “DSCR,” the debt service coverage ratio measures a borrower's ability to repay on a loan. Balloon payments are more common on commercial real estate mortgages than residential home mortgages, although plenty of home mortgages with balloons are available.īasis Point (BP) - 1/100th of 1%. The repayment is normally made toward the end of the loan's term or at the very end. Most amortization schedules decrease how much of a payment goes toward interest and increase how much goes toward principal as the loan proceeds.īalloon Payment: A one-time payment that's made at a specific point in a loan's repayment schedule. The payments are divided between principal and interest.

Terms to Know When Applying For a Commercial Real Estate LoanĪs you consider different real estate mortgage options and use the mortgage calculator, there are several technical terms to be familiar with and we aĪmortization Period: A method of debt repayment, in which fixed payments are made on a prearranged schedule. Your mortgage payment and all of these other expenses should fit comfortably into your company's monthly budget. Other expenses to keep in mind include landscaping fees, utility costs (including heating and air conditioning costs) and maintenance costs. You'll also have to pay insurance premiums and taxes, and these costs frequently get broken up into monthly escrow payments even though they're due just once per year.

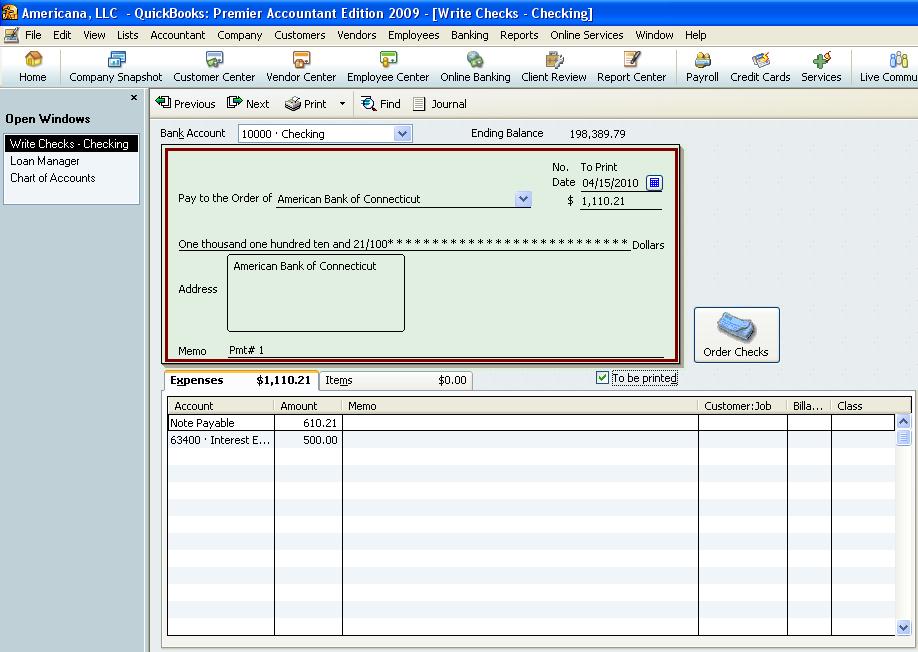

When evaluating whether you can afford a particular mortgage, it's important to keep in mind that your mortgage payment is only one of the costs that come with purchasing a commercial property. Most of your payment will go towards interest at the start of the loan, but it'll shift to primarily going toward the balance as your mortgage nears its end. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan.

What the Real Estate Mortgage Calculator Shows In some cases the amortization can have a bigger impact on the monthly payment than the actual interest rate of the commercial loan. Often overlooked is the amortization schedule when calculating payments. The duration of most Commercial real estate mortgages varies from five years (or less) to 20 years, and the amortization period is often longer than the term of the loan.

COMMERCIAL MORTGAGE CALCULATOR QUICKBOOKS MAC

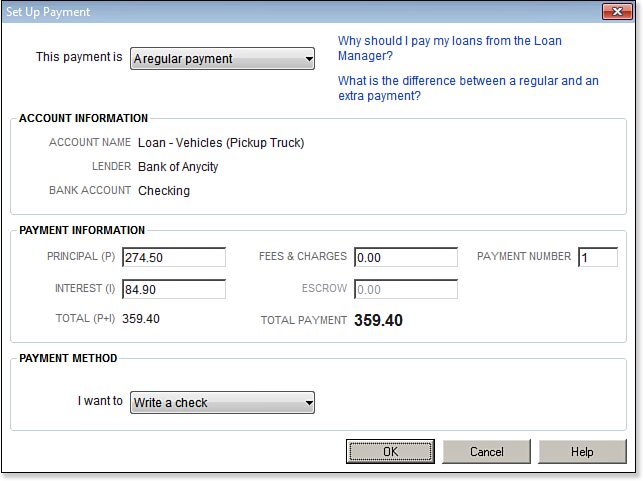

Whether you are looking at Fannie Mae Multifamily loan, Freddie Mac Multifamily loan, CMBS loan, or FHA/HUD commercial multifamily loans, there are a few specifics you must provide. Based on the data you input, the Commercial loan calculator will help you calculate your estimated monthly Principal and Interest (P&I) payment for the loan and an Interest Only payment and Balloon payment.

COMMERCIAL MORTGAGE CALCULATOR QUICKBOOKS FREE

Use our free commercial real estate loan calculator to calculate the details of a commercial mortgage easily and quickly.

0 kommentar(er)

0 kommentar(er)